History

History

In 1987 the Aruban Government and several private parties joined forces to establish a new bank, AIB Bank N.V. (formerly Aruban Investment Bank). The bank was founded on October 20, 1987. It became operational on January 6, 1988.

The Establishment of AIB

Roughly a year and a half into Status Aparte, the closure of the refinery had brought a widespread recession to Aruba with very high unemployment levels. It was a difficult economic time for Aruba. The government had a vision to establish a vehicle such as an investment bank together with other stakeholders participating as a permanent means of financing investment in order to create jobs in the economy, with tourism as the new promising sector for investment.

During the establishment of AIB Bank N.V. (formerly Aruban Investment Bank), the shareholding structure was designed in such a way as to ensure that no shareholder will have a controlling interest in the bank and that there would be a balanced corporate structure, proper supervision and management by a team of professionals.

As part of a settlement with the refinery, Aruba would receive compensation which could be channeled through the investment bank. Unfortunately, no settlement was reached and local shareholders had to provide additional support in order to meet the minimum capital requirement to start the bank. Further, the government assisted the bank with an AFL 20 million loan with the agreement that the government will not have a controlling position within the bank, thereby allowing the bank to act as an independent corporate body.

The government’s presence in the corporate structure of the bank, however, was assured through the office of the chairman of the Supervisory Board, which was assigned to Mr. E.F. Mansur, the then Minister of Economic Affairs and Tourism. The other Board members were Mr. L.M. Overmars, Mr. H.J. Schnog, Mr. E.A. Escalona, Mr. M.S. Kuiperi, Mr. J. Linker, Mr. E.J. Profet, and Mr. J.M. Verdaasdonk. Mr. R. Timmer replaced Mr. J. Linker as of July 14, 1988. When the government loan was fully repaid, the government representation was no longer required and from then on, the chairman of the board is elected by the board and the bank’s shareholders. The first management board consisted of Mr. H. Mehran as president and Mr. L. Wong as Vice-President.

Key Highlights of Over 30 Years

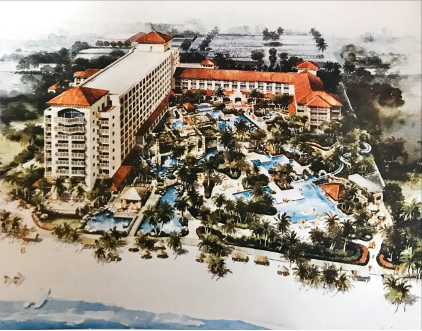

As the bank was being established and staff recruited, the bank’s first promotional investment was the Hyatt hotel for which debt financing, shareholding, operations and construction were being negotiated with various stakeholders and coordinated on behalf of the government. This was Aruba’s first major hotel investment without a government guarantee. This means that this was the first time that the government did not need to provide any guarantee for the event that the developer defaults and has thus in this way reduced the risk for the government of Aruba.

Other achievements in the early years were the management of the portfolio of Banco Arubano di Desaroyo, advising on various development and construction projects in Aruba, such as the development of a golf course which is now the Tierra del Sol golf community. AIB also supported the government with the development of a strategy to introduce Aruba to the international capital markets, including contacts with rating agencies and investment banks, and provided financing for several projects and businesses across a wide range of sectors.

As an independent organization, AIB has for many years been able to create both tangible and intangible value for our customers and business partners. In creating this value we have been taking calculated risks which other financial institutions were not able to take. Over the years we have developed a strong foundation of knowledge and experience together with a diverse team of skilled professionals and a robust company structure.

An overview of key highlights:

- Successfully managed the funds of the Government of Aruba and the Government of the Netherlands through the Fondo Desaroyo Aruba (FDA) initially for 10 years and then extended to a total of 18 years

- Together with another local financial institution, incorporate a special purpose vehicle, Stichting Onroerend Goed Aruba (SOGA), to develop, maintain, and manage investment projects for the Government of Aruba

- Arranged financing for the development and construction of various large hotel projects in Aruba and the region, and provided agency services for the syndicated loans

- Assisted with several large-scale infrastructure projects such as the relocation of the port to Barcadera, the Green Corridor, and the Watty Vos Boulevard

- Provided financing and advisory to projects and small businesses within various sectors of industry, such as tourism or tourism related services, real estate, manufacturing industry and agroindustry

- Invested in various equity investment opportunities, such as Arugas N.V. and the restauration of the John F. Kennedy Education Center